Bloodgang,

Welcome to the sixty-second issue of Bloodgood’s notes. The idea of this newsletter is to give you an overview of the previous week’s fundamentals and what happened on charts as well as to remind you of this week’s articles, secret TA tips, and trading calls. Basically, it’s about giving you all the key info in one place.

Table of contents

- Fundamental overview

- Bitcoin and Ethereum chart

- Blood’s content recap

- Concluding notes

As this community grows, I have a duty to give back to all of you that helped me and supported me to become what I am. This free newsletter is just another way to share my experiences and prepare you for the journey that’s ahead of you.

Love,

Blood

Binance and CTFC explained, Arbitrum drama and high timeframe charts.

Fundamental overview

As we’re entering into a new quarter, things seem to just keep getting crazier all over the place. Soon after I sent last week’s newsletter, the news on the CFTC (Commodity Futures Trading Commission) case against Binance came out, and it’s far worse than anyone anticipated. For one thing, regulators have insider info—including chat logs with CZ and other senior management figures—on how Binance wasn’t exactly doing all it can to stay compliant with US laws, and even people casually mentioning everything from money laundering for insurgent groups to helping VIP accounts avoid KYC/AML measures.

The overall attitude in the chat logs is one of complete disregard for US regulations, as CZ was probably convinced that they can dodge any issues by claiming that Binance US was a separate entity, but it looks like that backfired completely, since the CFTC case claims that all of their different legal entities lead back to CZ as the ultimate beneficial owner. The question is now how Binance will respond: if they don’t fight the case in court, the CFTC will win and Binance will have to pay an insane amount of fees (including reimbursing all US users for losses), along with being banned from doing pretty much anything in the US in the future. On the other hand, if they take up the legal battle, they will have to open up all their books and show the inner workings of the company—which, in case they’ve got some more skeletons in the closet, could be even worse.

Long story short, Binance is in for a really tough fight, one that could be made much more difficult if other allegations are tacked on (from the Department of Justice, for example). While these things do take some time to play out, this will be the key story to monitor in the coming months, especially given how Binance’s market share has become even more of a systemic risk for crypto since the FTX collapse. The possible outcomes range from bad to worse, and the only hope is that some kind of a settlement could be made with the CFTC, one which would cripple Binance financially (along with destroying any chances of them offering trading to US residents), while still making it possible for the exchange to continue operating in other jurisdictions to ultimately make up for the loss.

The most interesting thing to note about this whole drama is that, even though anti-crypto regulators and politicians are throwing everything they’ve got at this barely decade-old industry, this isn’t really showing up on the charts as much as you’d expect. One important reason behind this is probably the backdrop of the banking crisis: Elizabeth Warren and other anti-crypto crusaders can scream all they want, but who will listen to them when the banking sector is bursting at the seams, with the only rescue being a new near-infinite dose of Fed liquidity?

Bitcoin

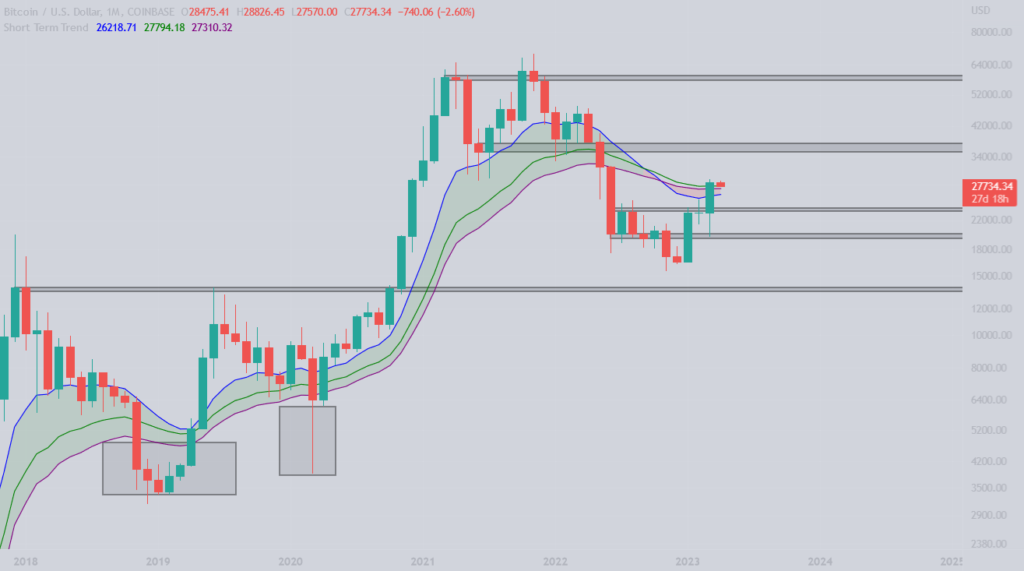

Bitcoin Monthly

Bitcoin Weekly

Bitcoin Daily

Bitcoin Dominance

Bitcoin monthly closes above the short term EMAs.

Even though we have a red Monday, with Bitcoin and alts having a small retrace, we still have some bullish signs on Bitcoin on multiple timeframes. A few letters back we argued that a close above the short-term EMAs is key for continuation. Given the fact that it is retracing, it is of crucial importance that this level is not rejected. In case of a fakeout, we are looking towards the key monthly level of $23,500-$24,000 where I will place bids if we head towards it.

The weekly timeframe is showing indecision between bulls and bears, but is still comfortably above the short-term EMA’s as well as the weekly EMA 200. On the other hand, there is a bearish divergence playing out on On Balance Volume (OBV), as price has made several higher highs, while OBV peaked in January, making several lower highs. The RSI has remained in an uptrend, but is still unable to break above the 80 level. In case of a retrace, a confluence of the weekly EMA 200 and summer range high should be bought, and if bulls are unable to defend it, the range comes back into play.

The daily timeframe looks like a good place to buy as it retests the short-term EMA cloud, however indicators are screaming bearish. OBV is in a downtrend as price made higher highs, and the same goes for the RSI. Moreover, the MACD made a bearish crossover. In case of a larger retrace, the bottom of the EMA cloud should be monitored as it could provide a good opportunity to buy, if that level is lost we are looking at the summer range high. The range high is of key importance and has to be defended if we want to see continuation.

Bitcoin dominance has skyrocketed in the last few weeks, outperforming alts with no mercy. However, it was unable to push above a year-long resistance. You want to put this chart on your watchlist because it will help you position in alts better. There is a big gap above if BTC dominance manages to break this level. If the level is broken, alts will suffer both in BTC and USD value.

SPX, Gold and DXY

S&P 500

U.S. Dollar Index

Gold

S&P 500 is back in the uptrend?

We can argue that a higher low was printed, but barely. An important note here is that the EMA 200 was cleared and confirmed on the daily timeframe and, as of Friday, the price is breaking above the 4096 level which proved too strong to be broken since late 2022.

The US dollar is taking a beating, and no wonder. It has lost a key level at 103.66, which we argued that it must hold if anyone wanted to see continuation. But since most of us want DXY to go down, so that risk-on assets can pump, the bearish case is a cause for celebration.

A week later and gold is still trading below the resistance, unable to break above. We might see a retrace towards the 1916 level if there’s no “crash of the monetary system” narrative before the next FOMC event.

Ethereum

Ethereum/Dollar Daily

Ethereum/BTC daily

Ethereum is in a similar situation to Bitcoin, as it’s trading right above the short-term EMA cloud.

However in this case we can see a spike in the OBV as traders are becoming more interested in it, due to the upcoming upgrade on April 12 when unstaking ETH will become possible. There is still confusion on Crypto Twitter whether that’s bullish or bearish. I have already shared my view on it, but here is a short recap. Short term we could expect a bit of a sell-off, but long term it is bullish due to the low amount of staked tokens. PoS chains usually have 60%-75% of their supply staked while Ethereum has only 15% at the moment. Investors don’t want to stake if they are unable to unstake, and now there’s every reason to believe that the percentage of staked coins will start to catch up to that of other PoS networks.

Ethereum/Bitcoin is stuck below a key level, trying to break above, however there is a confluence of the short-term EMA cloud as well as the 0.065 level. There’s still 9 days left until the Ethereum upgrade and with the bullish narrative around the event we could see this level get broken.

Will update the chart on Twitter if this is rejected.

Blood’s content recap

New Book Chapter is live!

“Don’t trust centralized exchanges?

Master all about DEXs with chapter 5 of my Book.

You will learn about

– DEXs & CEXs

– Rollups

– AMM

– Dex aggregators

– How to use DEXs

– Ways to earn money without trading

PDF is Free and available on my Website.“

Comment on the upcoming Ethereum unlock

“ Staked Ethereum will unlock on April 12th

Some will sell in fear of staked ETH being released. But..

1. 15% of ETH supply is staked, other large PoS have 60-75% of their supply staked

2. More people will stake, knowing they can unstake

You need balls to create wealth.“

Concluding notes

Apart from the CFTC v Binance situation, there’s a lot of drama going on in decentralized governance as well. Soon after launching, Arbitrum put out a very controversial governance proposal that would see a billion dollars worth of tokens allocated to a wallet directly controlled by the Arbitrum Foundation, which could spend those funds on “Special Grants” without approval from token holders. To make matters worse, once the backlash on Twitter started, Arbitrum revealed that the proposal was only made to ratify the decision, in other words that the decision had already been made and voters were only expected to confirm it rather than deciding on it. This is, obviously, a huge problem both in terms of decentralized governance and potential future regulatory pressure, but luckily it seems that the Arbitrum DAO will try to fix the situation as the initial proposal currently has over 80% of votes against it.

The reason I’m mentioning this is that this kind of thing is relevant for DAOs and L2s in general. It’s not that everything has to be decentralized, but if prominent networks overpromise and heavily underdeliver on decentralization, then they’re not only betraying their vision, but also making the whole industry an easier target for regulators. We’ve seen that the likes of Gensler and Warren are eager to do whatever they can to damage crypto, and if there’s one thing we should avoid, it’s making that task easier for them.