Bloodgang,

Welcome to the forty-seventh issue of Bloodgood’s notes. The idea of this newsletter is to give you an overview of the previous week’s fundamentals and what happened on charts as well as to remind you of this week’s articles, secret TA tips, and trading calls. Basically, it’s about giving you all the key info in one place.

Table of contents

- Fundamental overview

- Bitcoin and Ethereum chart

- Blood’s content recap

- Concluding notes

As this community grows, I have a duty to give back to all of you that helped me and supported me to become what I am. This free newsletter is just another way to share my experiences and prepare you for the journey that’s ahead of you.

Love,

Blood

Fundamental overview

Stocks had their third bad week in a row, with the S&P 500 closing right on the 200-week moving average, which it hadn’t touched since the Covid crash in 2020. It spent most of the week going sideways, but then started cascading down right before Friday’s close. Overall, things aren’t looking too good in macro terms, and let’s not forget that the realm of geopolitics is getting more tense by the day, as both of the Nord Stream pipelines were apparently sabotaged.

How will this reflect on monetary policy? What I said in previous newsletters about a Fed pivot being possible after the US midterm elections still holds, but it looks like a different central bank was already forced to shift in a more dovish direction. As pension funds in the UK threatened to blow up in what would have been a devastating crash, the Bank of England stepped in by propping up the bond market, highlighting that this is supposed to be a temporary intervention (but we know what “temporary” means, don’t we). All in all, this twist is far from bullish in the same way that a Fed pivot would be, but in any case central banks will only pivot when things start to break, which they’re clearly starting to do.

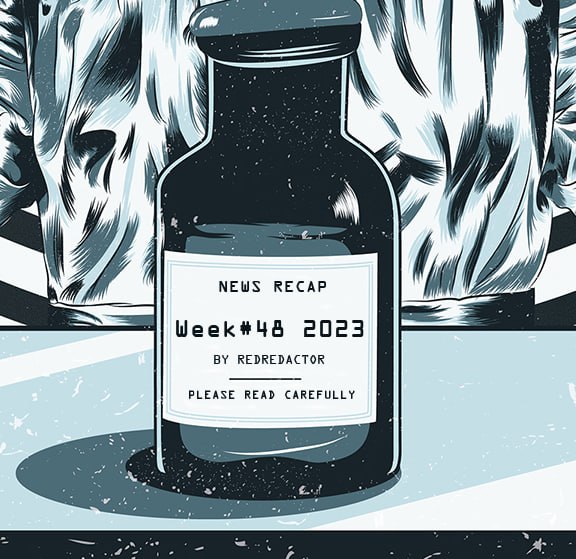

Bitcoin

Bitcoin/Dollar Weekly chart

S&P 500

DXY

An interesting week that triggered a lot of confusion among investors is behind us.

DXY finally started dropping, but this time we didn’t get the reaction we wanted on Bitcoin. At the same time that the US Dollar started dropping, we have seen a drop in Nasdaq, S&P 500 and Bitcoin. The only asset I managed to see going up was Gold on that day.

Anyway, DXY is still in a perfect uptrend with a minor retrace, still looking for new highs sooner than later, on the other side S&P 500 just lost the local low. Investors were looking for a bounce as the double bottom pattern has been forming on the D1 timeframe, but the pattern did not play out, and it looks like there is more downside potential on SPX.

Bitcoin on the other hand is still glued to the zone we talked about last week, the 2017 ATH zone. If everything is dumping (including Nasdaq, SPX and DXY) and Bitcoin holds this range we should be happy. Weekly volume is still increasing which indicates that more and more investors are interested in BTC at current levels.

Ethereum

Ethereum/Dollar Weekly chart

Ethereum/Bitcoin Weekly chart

Ethereum is still trying to get momentum after the successful Merge.

It seems to be that ETH after the merge is slowly dying, weekly candles on USDT pair have small bodies, which indicates that there is not a lot of activity going on. The weekly volume is slowly decreasing, which also confirms the fact that traders are not interested in trading ETH at the moment. From a technical standpoint, we can see that ETH is trading under the important weekly technical level at $1300-$1350 which we were bidding not long ago. For a long term trade this is still a good entry in my opinion, but keep in mind that we could revisit the $1000 level. My bids are ready in case that happens, and yours should be as well.

The ETH//BTC pair is slowly approaching the important support level at 0.065 BTC which is where I will be looking to swap some Bitcoin for Ethereum in case traders become interested in this altcoin once again.

Blood’s content recap

Don’t spend crypto profits on luxury items!

“Reinvest your profits and stop buying flashy watches, because this is how you will become poor again.

Use fresh capital to:

- start a small business

- buy real estate & renovate it

- invest in tech startups

Concentrate to get wealthy and diversify to stay wealthy.”

My view on when Bitcoin will resume uptrend

“US midterm elections are on Nov. 8th. Inflation hurts more people than stocks/crypto crashing, hence it makes sense for FED to focus on the prior. Once elections are over, then we have a real opportunity to change monetary policy which will impact $DXY. $DXY down, #Bitcoin up.”

Concluding notes

We can’t have a global crisis without banks threatening to collapse, and this time it’s Credit Suisse that seems to be in danger. As CDSs (credit default swaps, basically bets on a default) started to spike on Friday, the bank tried to reassure investors that everything is okay. We’ve seen how similar attempts at reassurance turned out in crypto this year, which is why many are wondering whether this could be another Lehman moment – referring to the Lehman Brothers collapse in 2008. It’s impossible to know how serious the problem is at this point, as the CDS spike could be exacerbated by the gloomy mood in the market as a whole, but if we do see a collapse here, that would have huge repercussions. Among other things, it would make inflation look like much less of a problem.