Bloodgang,

Welcome to the forty-fifth issue of Bloodgood’s notes. The idea of this newsletter is to give you an overview of the previous week’s fundamentals and what happened on charts as well as to remind you of this week’s articles, secret TA tips, and trading calls. Basically, it’s about giving you all the key info in one place.

Table of contents

- Fundamental overview

- Bitcoin and Ethereum chart

- Blood’s content recap

- Concluding notes

As this community grows, I have a duty to give back to all of you that helped me and supported me to become what I am. This free newsletter is just another way to share my experiences and prepare you for the journey that’s ahead of you.

Love,

Blood

Fundamental overview

A lot of things happened last week, but essentially only one of them was good: the Ethereum Merge went by flawlessly, without any sort of technical difficulties. If you had some ETH in non-custodial wallets (or some exchanges), then you’ll also have the same number of ETHW coins on the Proof-of-Work fork, but these unsurprisingly dumped to single digits very quickly.

Meanwhile in TradFi, CPI data came in hotter than expected, leading to the absolute nuke we’ve been seeing in equities and especially crypto. Don’t forget that there will be a Fed rate hike this week, with 75 basis points very much on the table, and some even see 100 bps as an option. After that, the Fed should be more “data-driven,” which means that a cooldown in inflation would fan the flames of the Fed pivot narrative to an insane extent.

Bitcoin

Bitcoin/Dollar Weekly chart

Bitcoin/Dollar Weekly chart

Bitcoin trades below the key support level on a bloody Monday.

If we thought we were in a bad enough situation last week when volume was dropping while trading on support, we were wrong. The weekly candle closed right above support, right before it dropped below $19,000, which makes it hard to trade as it could very well be a bear trap. There was a 50% increase in Bitcoin shorts on Bitfinex overnight. I am staying on the sidelines for this one as this could be a very volatile zone, especially because it’s bulls’ last hope to stay close to $20,000.

I will monitor the current local bottom on Bitcoin in case we get any reaction there, but for now it doesn’t look like bulls are interested in buying at current levels. If the weekly support is lost we are then eyeing the monthly level, which is right below $14,000. The Merge couldn’t trigger a run to the upside and it was by far one of the biggest events in crypto. The macro situation is not improving so we have to be prepared for everything and most importantly, be ready to bid! Wealth is made in times like this, do not miss your opportunity.

Ethereum

Ethereum/Dollar Weekly chart

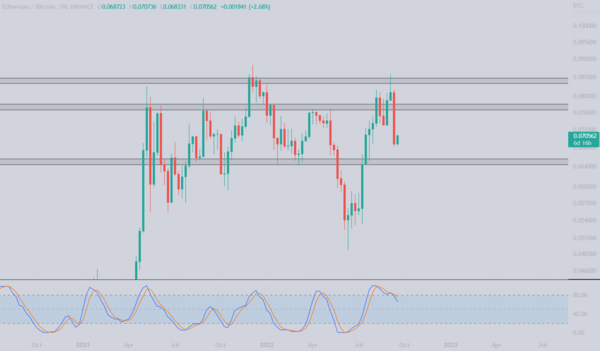

Ethereum/Bitcoin Weekly chart

Ethereum took a hit after the successful Merge.

It was a sell the news event after all—as soon after the Merge happened we saw ETH drop by over 10% whereas other L1s dropped a few percentage points, some were even green. The merge drop pushed Ether below the $1350 level which was the support area of our range and our bids got filled here. If you followed this trade I suggest keeping a tight stop loss in case Bitcoin loses the weekly support and starts heading towards $14k. The weekly stoch RSI is still close to the overbought area which indicates buyer exhaustion and will need a proper reset.

Looking at the ETH/BTC chart we can see that the last resistance at 0.085 BTC which we argued will be broken due to the Merge is still too strong for ETH. It managed to break above it, but only for a day, before getting rejected. In fact it lost two key levels, dropping to almost 0.065 BTC. Currently it is trading right in between both levels which doesn’t make it interesting, but if it drops to 0.065 i will be looking to swap some Bitcoin for ETH.

Blood’s content recap

My 2022/2023 crypto portfolio

“BTC: 20%

ETH: 10%

Stablecoins: 30%

Trading capital: 10%

Staking: 10%

High potential (20x-50x) altcoins: 20%

Doing FA on alts, just 20% of porfolio, but they make the difference in final balance.

Will also share alt porfolio once done with anaylsis.

Sentiment cheatsheet

“In bear

- Bad news results in lower prices

- Good news should be sold into

If this is not the case, thats the sign of strength

In bull

- Bad news should be bought into

- Good news should lead to higher prices.

If not the case, thats the sign of weakness”

Concluding notes

This sort of price action should serve as a lesson on the difference between slowly DCAing and going max leveraged long, which I’ve been highlighting ever since $20k BTC was first on the table. One way to do this is to view a portion of your coins, which you preferably hold on a cold wallet, as more of an insurance policy than an active trade. You never know what could happen in this unstable global environment, and your coins—provided you’re smart about how you’re storing them—are the one asset that no government can ever confiscate.