Bloodgang,

Welcome to the forty-eight issue of Bloodgood’s notes. The idea of this newsletter is to give you an overview of the previous week’s fundamentals and what happened on charts as well as to remind you of this week’s articles, secret TA tips, and trading calls. Basically, it’s about giving you all the key info in one place.

Table of contents

- Fundamental overview

- Bitcoin and Ethereum chart

- Blood’s content recap

- Concluding notes

As this community grows, I have a duty to give back to all of you that helped me and supported me to become what I am. This free newsletter is just another way to share my experiences and prepare you for the journey that’s ahead of you.

Love,

Blood

Fundamental overview

The conflict in Ukraine seems to be escalating rapidly in the past few days, and now the economic aspect of it is also tightening: the EU just introduced a complete ban on crypto payments to Russians. This means that Russians will no longer have access to any crypto service providers that want to avoid serious trouble with the EU, but it of course doesn’t apply for unhosted, on-chain transactions. Not that unhosted wallets make much of a difference in day-to-day life, since your average Joe (and your average Boris alike) won’t bother with using that—at least, that is, until that becomes necessary.

Safe to say that the geopolitical outlook isn’t exactly getting any better, and as for the current macro-level situation in economics (you know, the stuff that influences stonks and crypto just as much as any war ever could), we’ll soon find out what kind of mood Powell & Co. are likely to be in for the coming meetings. New CPI data for the US will be published this Thursday, with a forecast of 8.1% for YoY inflation, compared to 8.3% previously. As always, keep an eye on the news and don’t get trapped in Thursday’s (likely) volatility, but the gist of it is simple: if inflation looks like it’s getting under control, the Fed is likely to loosen up sooner than expected.

Bitcoin, DXY and S&P500

Bitcoin/Dollar Weekly chart

S&P 500

DXY

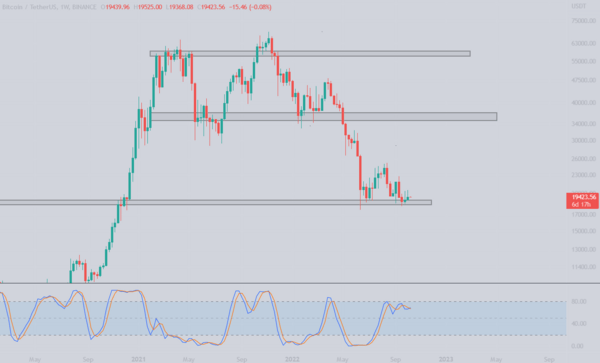

Another Bitcoin weekly candle close above the 2017 ATH zone, are we finally seeing a bounce or are we in for a breakdown?

As DXY proves it is still in a perfect uptrend as discussed last week, it is looking to make new highs sooner rather than later. We know the effect of rising DXY is not good for Bitcoin but the parabola cannot go on forever. As I mentioned a couple of times, I predict this madness to go on somewhere until the Nov 8th midterm elections. Only after the elections can we see a change in the monetary policy.

Last week, volume was dropping day by day, which we don’t want to see especially if the price is going up. It seems that bulls are mostly interested in Bitcoin as it drops to $19,000 or lower, we will see if our theory is true next time we retest these levels. The weekly stoch RSI still remains right under the overbought zone, looking to either retest the midline or break above. Either way, a reset in the RSI would be good for continuation.

The S&P 500 is hanging right on the previous local low. The double bottom pattern we were looking for last week is not playing out like we wanted it to. Even though bulls managed to get a bounce after a lower low was made, it got rejected quite quickly, only to drop to the “double bottom” line.

Ethereum

Ethereum/Dollar Daily chart

Ethereum/Bitcoin Weekly chart

Ethereum still continues to be as boring as it can possibly be on the weekly level.

Looking deeper into the daily timeframe we can see that a series of higher lows were formed and the price is slowly making its way higher and above the $1350 level which we have monitored for quite a few weeks. The thing that worries me is the decreasing volume. If the price is rising and the volume dropping, that usually leads to a crash or a breakdown. Moreover, the Stoch RSI has also exited the overbought area and looks like it could be reset.

The ETH/BTC chart is still above the 0.065 BTC level which we have been watching for some time. This is beginning to look like a good place to swap BTC to ETH, but I am waiting for a reaction on the USD pair first. In case we are not breaking down there I will definitely buy some ETH and look to derisk around 0.075-0.08 BTC.

Blood’s content recap

New upcoming article

“Rekt “bottom buyers” have one thing in common – no criteria for trend reversals.

Study these trend indicators and patterns in detail.

- OBV (bear/bull divergence)

- Higher high formation after lower low

- MACD (trend reversals on EMA crossover)

Writing an article with examples”

New scalping exercise

“Scalping Exercise #4 – EMA & Stoch RSI

- Open a chart with 3 EMAs (Eg. 13,25,30)

- Seek “ema cloud” tests

- If coming from below SHORT & LONG from above

- Find confluence with Stoch, only trade if oversold/overbought

- Backtest before trading

Soon you will be MASTER scalper🚀”

Scalping Exercise #4 – EMA & Stoch RSI

— Bloodgood (@bloodgoodBTC) October 3, 2022

– Open a chart with 3 EMAs (Eg. 13,25,30)

– Seek "ema cloud" tests

– If coming from below SHORT & LONG from above

– Find confluence with Stoch, only trade if oversold/overbought

– Backtest before trading

Soon you will be MASTER scalper🚀 pic.twitter.com/CVHm9koVEV

Concluding notes

Remember the extremely “temporary” and “measured” policy of the Bank of England to buy up to 5 billion GBP worth of bonds daily in order to prevent the UK’s pension funds—and much more than that—from collapsing in the mother of all flash crashes? Well, as you would expect from a policy that was as nuanced, measured and well thought out as that one, they… uhm, so, they just doubled it to 10 billion GBP per day. Yeah.

In situations like this, people tend to be perplexed by the fact that, apparently, the BoE doesn’t really know what it’s doing. Surely, if anyone is supposed to have a proper grip on reality right now, it ought to be them, right? Unfortunately, that is just not the case, and this kind of thing happens more often than you might think. Think back to Three Arrows Capital: they were looked upon as some kind of trading demigods, using leverage (and the occasional psyops) to absolutely rob all other market participants of their money. How did that turn out? Instead of liquidating plebes, it was none but Su Zhu that found himself on the receiving end of the dreaded liquidation emails. The emperor had no clothes—but everyone was too busy believing that 3AC was invincible to have any doubt in their prowess, until it was too late. What happens when it’s a central bank and not a degen crypto fund next time? Never overestimate competence, especially when it’s about governments or banks.